|

So far, under the RGGI program, Delaware has received $187 million in revenue, and as much as $100 million may be sitting unspent. The state program intended to reduce emissions may actually be increasing emissions globally.

We recommend a legislatively mandated one-year RGGI "tax-free carbon holiday" that would include a thorough review of the program and how the tax revenue is allocated.

In 2016 Delaware generated 78% of its electric demand in-state, but in 2021 we were down to 36%. We may be close to zero in-state generation as early as 2024. That means lost jobs, lost state and local tax revenues, higher electric rates, and possibly lower power reliability.

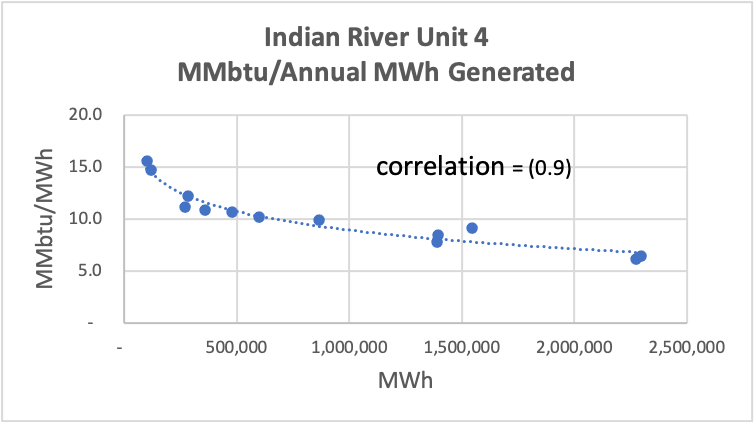

Low use of power plants can double emissions (see graph below), and longer transmission lines add another 10% to emissions.

|

|

|

Our peer-reviewed study comparing RGGI states to non-RGGI states with otherwise similar energy policies shows that RGGI doesn't work to reduce emissions.

We estimate RGGI added 357,000 tons of CO2 per year to global emissions in 2021. At first, the allowances only cost a few dollars per ton, and electricity wholesale prices were higher than today.

However, the latest auction price was $13.50 a ton, and that means Delaware natural gas power plants have to bid 15% higher into the regional grid than utilities in non-RGGI states to cover the tax, so they lose bids and don't generate as much power.

Delaware's lone emitting coal-powered plant in Millsboro must bid 34% higher prices as it emits over twice as much per unit of power as natural gas. NRG Energy has announced a plan to close the facility this year as it only operates about 15% of the time and can't cover the overhead.

The multistate RGGI manager forecasts electric rates rising by 40% by 2030 as higher allowance prices influence wholesale power prices even in non-RGGI states, and importing our power may increase costs by another 5% to cover the average line losses and congestion charges based on PJM data.

Legislation requires 65% of RGGI revenue to go to the Delaware Sustainable Energy Utility (DESEU), a private non-profit that provides grants for energy efficiency projects.

Their budget and audit reports show they spend only about $7 to $8 million a year on program grants and administrative costs. Their reports show only about 4,000 tons of annualized CO2 emissions savings or a cost of about $2,000/ton.

Emission savings claims are not backed by the audit that matters; before and after project electric and gas meter readings, so the claimed savings are doubtful.

RGGI revenue to the DESEU was $24 million in 2021 and should rise to $34 million in 2022. The DESEU has been accumulating unspent funds for over a decade and likely had $73 million by the end of 2021, and will be close to $100 million by the end of 2022, or about 13 years of expenses.

They have been giving loans to boost interest revenue and minimize their stash of cash. Still, there is no evidence that the projects they have financed couldn't have been borrowed elsewhere.

Clearly, it is time to stop sending money automatically to the DESEU. They could still receive Grant-in-Aide grants from the state as many other private nonprofits do.

Delaware's Department of Natural Resources & Environmental Control (DNREC) receives 35% of the RGGI revenue.

Delaware's Low-Income Home Energy Assistant Program receives 5% to help pay utility bills. The DNREC's low-income Weatherization Assistance Program (WAP) receives 10% or almost $4 million in 2021. DNREC can spend the balance of about $7 million in 2021, supporting energy efficiency and renewable energy programs.

A DNREC website lists WAP projects completed by date.

It appears the WAP program has essentially closed for the last two pandemic years. Past annual reports from the Energy Efficiency Advisory Council suggest DNREC may only be spending $2.5 million a year on WAP and about $3.5 million on other projects from the RGGI funds.

DNREC has not responded to a Freedom of Information Act request for the recent spending history of RGGI funds or the total amount of unspent RGGI funds they have accumulated. Extrapolating from past reports, DNREC may have $20 to $25 million in unspent RGGI funds and would not suffer from a RGGI "tax-free carbon holiday."

The US Energy Information Administration just released survey results and found that 25 million American families (27%) reported forgoing basic necessities to pay energy bills sometime in 2020, while 7 million of those families reported doing so every month.

With inflation raging and energy costs hurting the poor and middle class, a RGGI "tax-free carbon holiday" makes sense. It makes even more sense to reconsider the entire RGGI program and its allocation of RGGI revenues. We note that New Hampshire returns RGGI revenue to electric customers, and Connecticut sends all RGGI revenue to its General Fund. |