Fast-Track Bill: Could Add $8,800 to Delaware Electric Bills

SB 170 was initiated by UD's Research in Wind & an offshore wind advocacy group that includes offshore wind developers. This bill is unnecessary when legislators have already introduced HB 99.

By David T. Stevenson, Director

Center for Energy & Environmental Policy

June 12, 2023

Bills released in the final nine legislative days are never a good idea. Delmarva Power customers are only half done paying a billion-dollar premium electric price over twenty years for the rushed Bloom Energy fuel cell legislation. Senate Bill 170 (SB 170), released last week (June 8th), could result in a $9 billion premium charge over a similar 20-year period adding $8,800 to residential electric bills and millions to some large industrial companies!

SB 170 was initiated by the University of Delaware Center for Research in Wind (CReW) and an offshore wind advocacy group that includes offshore wind developers. University of Delaware (UD) has proposed an 800-megawatt project subsidized by Delaware electric customers. Offshore wind projects often require additional large investments in transmission lines. For example, Dominion Energy in Virginia added almost $2 billion to its offshore wind project just for transmission upgrades. SB 170 would have DNREC investigate ways to reduce the cost of transmission lines and determine a bidding procedure for a Delaware-subsidized offshore wind Power Purchase Agreement.

Eighteen projects are in various stages of federal permitting after receiving large subsidies from various states. The most recently approved subsidy was from the Maryland Public Service Commission for the 846-megawatt Skipjack 2 project off the Delaware coast. Developer, Ørsted, will sell power and capacity value into the competitive regional electric grid, similar to any electric generator. In addition, they will also sell Offshore Wind Renewable Energy Credits (ORECs) to electric utility companies who, then will pass the cost onto their customers. The OREC price will average $146.42/megawatt-hour over the 20-year contract period based on the Skipjack 2 price and represents the premium cost of the project compared to other generation opportunities.

A Delaware subsidized 800-megawatt project with the same OREC price would add $452 million annually to electric bills1, or about $9 billion over twenty years. An average household would see electric bills go up $440/year, or $8,800 over twenty years. Lower-income residential customers might see costs go up to $560/year because they live in less efficient homes, according to the US Energy Information Agency2.

Cost is only one problem with SB 170; there are additional concerns below:

1) The requirement of Delaware's Department of Natural Resources & Environmental Control (DNREC) to consider offshore wind transmission issues is already in HB 99.

2) The potential of procuring offshore wind is already in Delaware's Climate Action Plan, as covered in HB 99.

3) All 18 existing projects went through utility commission procurement, so DNREC is the wrong state agency to be considering Power Purchase Agreements.

4) A working group established by the Governor recommended not buying offshore wind because it costs too much and further recommended the state include other zero-emission generation sources in any future competitive bidding process, such as onshore wind and solar.

5) There is no true competitive bidding process for offshore wind as a bidder must have a federally approved lease area, and only two such leases exist near Delaware.

6) Offshore wind costs have risen, with many state-approved projects now seeking revised, higher-priced state agreements.

7) Existing offshore wind leases are facing legal challenges over serious environmental impacts on endangered species, commercial fishing, navigation, tourism, and property values.

8) The bill has a long list of potential cost-offsetting benefits, but no list of costs to be considered. Besides the large premium price to electric consumers, that cost means money won't be spent elsewhere in the economy potentially killing 3,000 permanent jobs compared to several hundred temporary jobs and 25-50 permanent jobs created by offshore wind. The Maryland project developers have left open ocean leased areas closest to shore that would be the most likely spots used for a Delaware project which could reduce tourism and property values. There could also be lost commercial fishing revenue.

9) CO2 savings based on PJM data3 may only be a little over 1 million tons annually, only 3% of the premium power cost, and possibly less because inefficient peaker power plants would need to run when the wind stops, and emissions would be produced during manufacturing and installation of the turbines.

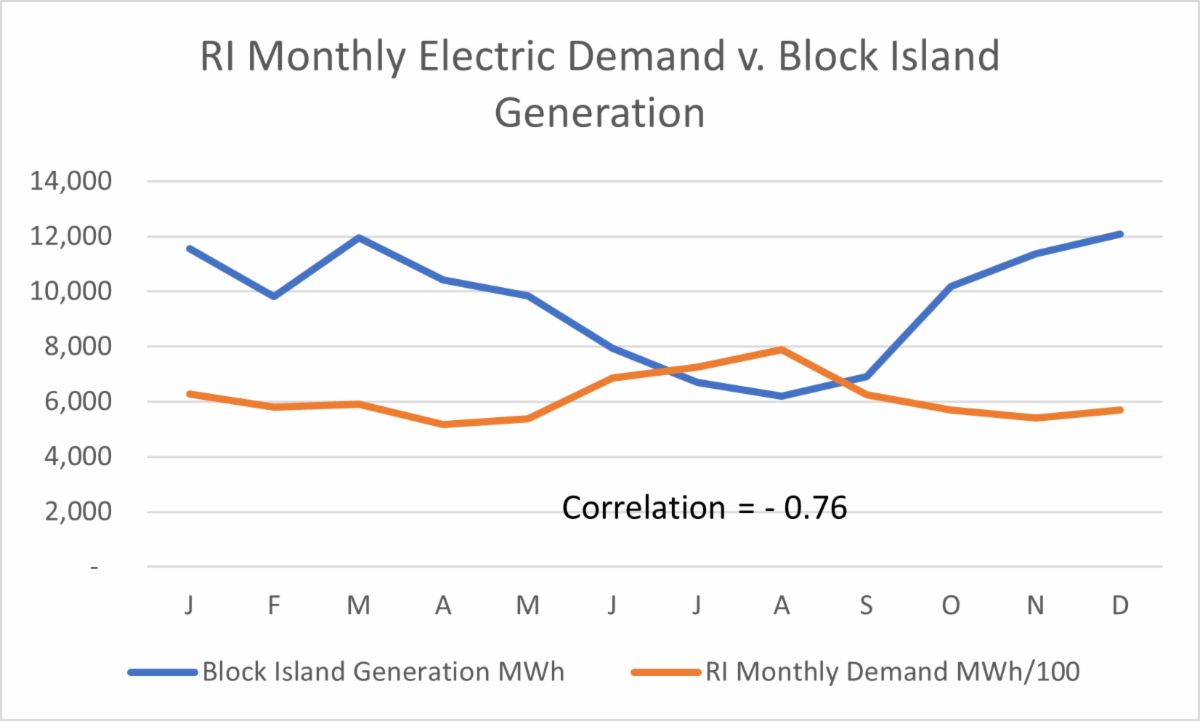

10) Offshore wind produces unreliable power, and Chart 1.0 below is based on six years of operating data from the Block Island offshore wind project, showing how most power is produced in the spring and fall when electric demand is lowest and the least power in the summer when demand is highest.

Chart 1.0

(Chart Source: US EIA Detailed State Historic data, https://www.eia.gov/electricity/data/state/)

SB 170 is unnecessary, as potential future offshore wind power procurement will already be considered in future Delaware Climate Action Plans as covered in HB 99. We can only hope that Delaware will not adopt offshore wind procurement considering its ridiculously high cost compared to other clean energy options.

NOTES:

- The announced Skipjack 2 first-year price was adjusted over the twenty-year contract period for a built-in price escalator to calculate the average $146.42/MWh price. Solar and onshore wind projects have no such escalators. The 800 MW facility will operate 44% of the time, according to the developer, or 3,854 hours a year, to produce 3,085,000 MWhs/year for an annual OREC cost of $452 million a year. Total electric demand in Delaware is avaregaing11,480,000 MWhs/year, so the added cost per MWh to customers is $39.35. The average Delaware residential customer uses 11.2 MWh/year, so the added cost per year is $440.

- A just released analysis by the US Energy Information Agency, "US energy insecure households were billed more for energy than other households," https://www.eia.gov/todayinenergy/detail.php?id=56640 , shows the lowest income electric customers pay 30% more than everyone else as they live in efficient homes, so they might pay $560/month.

- PJM Systems Mix, https://gats.pjm-eis.com/gats2/PublicReports/PJMSystemMix. The CO2 savings from the expected annual generation is only 1,080,000 metric tons per year as wind generation would simply offset the PJM regional grid systems mix, which is currently only averaging 0.35 metric tons/MWh. The current cost of Regional Greenhouse Gas Initiative (RGGI) carbon allowances is only about $13/ton, so the savings are only worth about $14 million, 3% of the annual electric premium. Some of those savings would be offset by the need to run inefficient peaker plants when the wind isn't blowing.