PJM Challenges the Narrative: What’s Really Driving Higher Electric Bills

PJM Interconnection, the organization that manages the electric grid for 13 states including Delaware, has confirmed what the Caesar Rodney Institute (CRI) has long argued: state mandates are raising bills and straining reliability. Delaware policymakers now face a choice-continue policies that risk higher costs and outages, or adopt measures that keep power reliable and protect families from higher bills.

For years, PJM largely went along with state energy policies, building infrastructure and running markets around political mandates, even as costs rose and reliability weakened. As complaints over rising bills mounted, state officials began deflecting blame onto PJM.

Until recently, PJM's leaders avoided confrontation, preferring a cautious approach. That stance shifted when Aftab Khan, PJM's executive vice president of operations, planning and security, published a commentary in Utility Dive. "We at PJM need realistic solutions, not politics, to take on energy challenges," Khan wrote. "Some public narratives have presented an inaccurate picture of PJM's role in cost-effectively keeping the lights on. Here are the facts."

The Limits of State Mandates

State policies urging 100% of electric power to come from wind and solar have struggled to deliver consistent results. Baseload power plants, such as those operating on natural gas, coal, oil, hydropower, and nuclear energy, can run 24/7 and respond to high demand on hot or cold days. Wind and solar often underperform just when electricity is needed most. For example, according to the real-time data from Electricity Map:

- On July 16, a dangerously hot day in the mid-Atlantic, electricity demand peaked between 6 and 8 p.m. Solar was operating at just 10% of its installed capacity, while wind was delivering 37%.

- On August 11, when a baseload power plant near Baltimore, MD went offline, wind supplied only 7% of capacity at 4 p.m.

Despite decades of mandates and subsidies, wind and solar account for only 12% of PJM's total capacity, according to PJM's 2024 State of the Markets Report. The same report shows 166 gigawatts of wind and solar projects in the approval queue, but only 32 gigawatts (19%) are expected to be built. That estimate was made before the One Big Beautiful Bill Act began cutting federal tax subsidies to green energy, making completion even less likely.

Growing Demand, Stagnant Supply

As Khan noted, PJM has approved large amounts of wind and solar, but projects face challenges outside PJM's control, including construction delays, financing, permitting, and supply chain issues. Meanwhile, baseload plants are retiring, often due to decarbonization policies. These include carbon taxes on natural gas and coal-fired plants, as well as restrictions on building new facilities to meet state net-zero emission targets.

Electric demand, however, is climbing. PJM's demand is growing and is tied to artificial intelligence, data centers, electrification, and a resurgence in U.S. manufacturing. In Delaware, electrification policies subsidize electric vehicles and restrict natural gas and propane for heating, cooking, and hot water.

On the supply side, Delaware is counting on offshore wind development, but federal policy makes new projects unlikely. The state's last coal-fired plant has closed, and its largest natural gas facilities are aging and up for sale. When demand rises and supply lags, prices increase-a basic economic principle.

Rising Costs for Consumers

Power plants earn revenue through two PJM auctions: capacity (for staying available to generate) and daily supply (for actual energy delivered).

Capacity shortages are driving steep price hikes. For most of PJM, capacity prices rose from $28.92 per megawatt-day in 2024-25 to $269.92 in 2025-26, and $329.17 in 2026-27. In Delaware, prices were already higher at $165.61 in 2024-25, so the jump was less dramatic than in New Jersey, where bills rose 17%-20%-about $312 per year-according to WHYY. Across PJM, bills are projected to rise about $78 annually in 2025. Delaware may see a 6% increase, or roughly $100 annually.

NOTE: A Jefferies Analyst, Julien Dumoulin-Smith, projected a capacity forecast chart for PJM that shows prices may increase to $1,145 per megawatt-day by 2029. Proportionately, that could raise residential electric rates by almost $100 a month, or more than $1,100 a year.

Daily supply prices are also volatile. Between 2020 and 2024, annual averages ranged from $21.65 to $80.17 per megawatt-hour, with 2024 averaging about $35.

Carbon Policies and Unintended Consequences

Some PJM states participate in the Regional Greenhouse Gas Initiative (RGGI), which requires carbon allowances for power plants. The program is designed to reduce emissions, but in practice it often raises auction prices and shifts generation rather than lowering overall output.

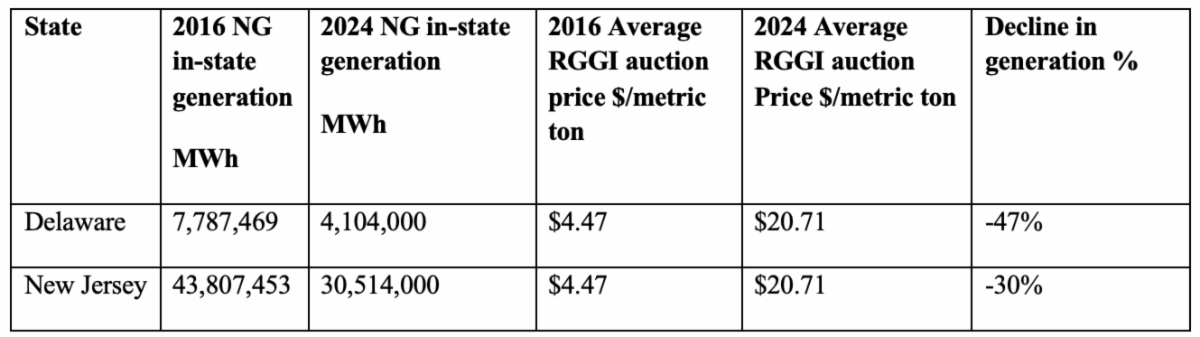

Relatively new, efficient power plants in New Jersey and Delaware lose out to older power plants in non-RGGI states, which do not face the same carbon costs. This shift can actually increase net greenhouse gas emissions. Table 1 below shows the change in in-state natural gas generation from 2016 to 2024 as RGGI auction prices rose.

While RGGI does not alter the outcome on high-demand days, it has reduced in-state generation. That increases transmission distance and congestion charges, which are passed on in electric bills but are not captured in official state calculations.

RGGI costs are added to electric bills, although the exact amount can vary. Because Delmarva Power buys power indirectly from market suppliers, the precise cost impact on Delaware customers cannot be calculated.

NOTE: Virginia provides a clearer example. Utilities there tracked RGGI costs directly, and according to the Virginia Mercury, Dominion Energy residential customers paid an average of $4.50 per month in 2023 when allowance prices averaged $13.49. That suggests customers would have paid about $6.50 per month, or $78 per year, in 2024 had Virginia not exited the program.

Broader data also show that RGGI has shifted, rather than reduced, emissions. Generation has moved from coal-fired power plants to much lower-emitting natural gas facilities, primarily because natural gas prices have dropped dramatically with the fracking revolution.

Natural gas prices fell from $8-$14 per thousand cubic feet in the 2000s to about $2.50 today. This price-driven shift has cut PJM carbon dioxide emissions by 41% since 2005, largely independent of RGGI.

Choices for Delaware Lawmakers

Higher costs and reliability risks come from policy choices, not PJM's markets. Delaware lawmakers have several options:

- Senate Bill 65 would withdraw Delaware from RGGI.

- House Bill 80 would reduce renewable mandates under the state's Renewable Portfolio Standard from 40% by 2035 to 10%. The bill was tabled earlier this year and needs to be reconsidered.

- A third bill could prohibit bans on natural gas and propane for heating, cooking, and hot water, ensuring families keep affordable options.

Looking ahead, if mandates remain, officials may face greater challenges responding to complaints about high bills. Research suggests that policies supporting baseload generation, reopening recently closed plants, or slowing retirements could help stabilize both costs and reliability.